The importance of making a profit routine—and sticking to it.

As humans, we’re all creatures of habit. We have our morning routine. Our work routine. Our pre-meeting routine. We all just like to get into a rhythm and keep it that way.

After all, sticking to a routine is the key to being productive. Successful people are well-known as sticklers for routine. Routine provides structure. It establishes a sense of security.

Which makes having to change routine so hard.

It means tearing down the habits we worked so hard to create. It means demolishing the cocoon of security around us. Forgetting what we always knew.

Yesterday, I learned this lesson firsthand.

We conducted another installment of our LTB Webinar series. The presenter, Mike Michalowicz, author of the best-seller, “Profit First”, provided a startling revelation about managing cash flow.

We all think that to arrive at our profits, we must take our sales, deduct our expenses, and then whatever is left is profit.

False.

While mathematically the formula might be true, it doesn’t take human nature into account. Fact is, most people will consume whatever is in front of them. Therefore, when we look at our bank accounts, if we see money in it we’ll spend. In our mind, that’s how we will grow our business.

The problem with this behavior, is that we start to spend aggressively – because we have the money. But what happens when sales slow? Then what? We’re left with very little – if anything – that we can take home as profit.

In fact, Mike pointed out, over 80% of small businesses face this problem. Solid sales one month, followed by a down period, followed by an “ok” month. The only constant is the inconsistency of it all.

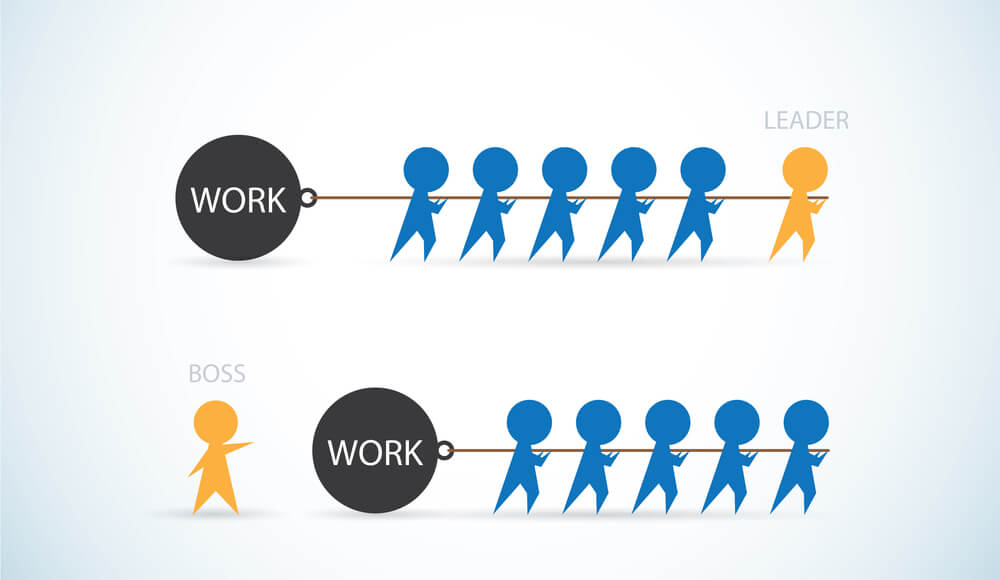

To solve this issue, said Mike, you first have to realize that profit is not an event. It’s a habit. Just like we all have our little routines, we can establish a routine called “profit routine”.

Profit is not an event. It’s a habit.

Establishing this routine entails following a series of small, simple, but profoundly effective steps. Allow me to share a few of the revolutionary measures Mike spoke about:

- The Serving Plate – The income account for your business has one purpose, and one purpose only: use it as a “serving plate” to distribute to other accounts. When we sit down to a meal, do we eat off the serving plate? Of course not. We use it to put on our smaller, individual plates. Likewise with your income account. Don’t use it to spend on anything. Simply distribute it to different plates.

- Smaller Plates – Ask any nutritionist what’s the best advice to give someone trying to lose weight? The answer is to use smaller plates. We have a habit of consuming whatever is in front of us. The more we have, the more frivolous we are. Instead, break down your resources and expenses into smaller accounts, or “plates”. Distribute them appropriately, and watch those frivolous expenditures disappear.

- Take Profit First – As entrepreneurs and small-business owners, we generally save our pay for last. If you think about it, that makes no sense! It’s our business. We should be the one to get paid first! The first plate to fill should be ours. Once you take away that money, now you can get creative distributing the rest of it to the other “plates”.

The purpose of this system, is that it causes us as entrepreneurs, as small business owners, as people struggling to maintain a proper cash flow, to do what we do best: innovate. We are all at our creative best when faced with a crisis, such as finding a way to pay our bills.

While the steps may seem simple, the ability to change a routine is exceptionally difficult. It’s therefore critical to have an ironclad mindset to develop the habit, to stick to that routine, no matter the obstacles. Developing a Profit Routine is no different. One has to be fully committed to persevere through the challenges, obstacles, and any other difficulties that may arise along the way.

The beauty of creating such a routine is that it applies to both business and personal finance. I strongly encourage everyone to go check out Mike’s system, where he addresses other critical topics, including getting out of debt, and how to properly allocate your money. It’s a proven system that really works.

I understand that many of you registered for this webinar – some able to attend, while others, unfortunately, were not. The mission of Let’s Talk Business is to keep the conversation going, using our skills and knowledge to help out one another. In keeping with that goal, I want as many people as possible to benefit from this webinar. If you know someone that stands to gain, please tell me, and I’ll send both of you the recording.

Onward and Upward,

Meny Hoffman